Decoding the Landscape: A Comprehensive Guide to the Kauai Tax Map Key

Related Articles: Decoding the Landscape: A Comprehensive Guide to the Kauai Tax Map Key

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Decoding the Landscape: A Comprehensive Guide to the Kauai Tax Map Key. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Decoding the Landscape: A Comprehensive Guide to the Kauai Tax Map Key

The Kauai Tax Map Key, a seemingly unassuming document, serves as a vital tool for understanding the intricate tapestry of land ownership and property boundaries on the island. It is a comprehensive guide, providing a framework for navigating the diverse landscape of Kauai, from its lush rainforests to its sun-drenched beaches. This article delves into the intricacies of the Kauai Tax Map Key, exploring its structure, its role in property identification, and its significance for various stakeholders.

The Anatomy of the Kauai Tax Map Key

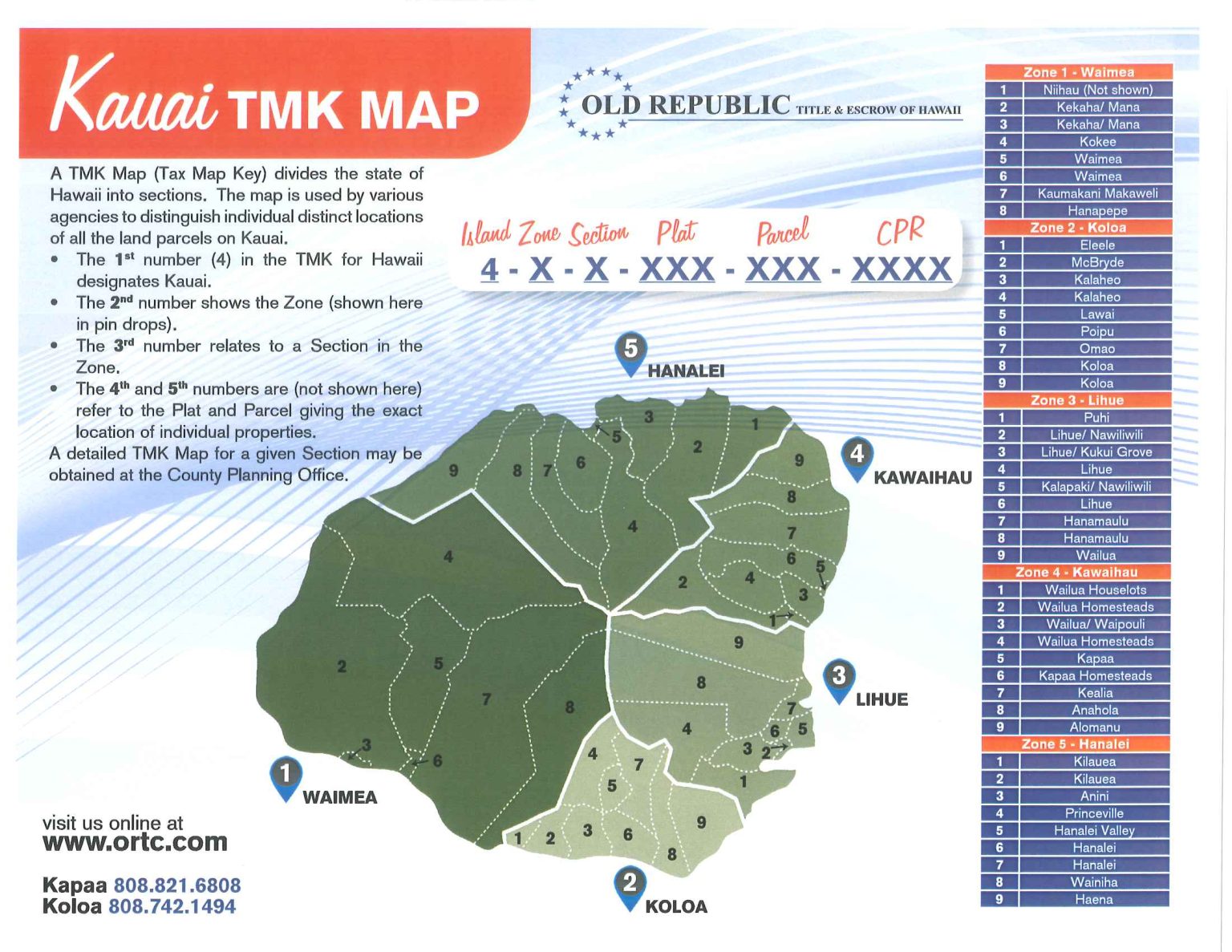

The Kauai Tax Map Key is a meticulously crafted system that assigns unique identifiers to each parcel of land on the island. This system operates on a hierarchical structure, dividing the island into progressively smaller units:

- District: The island is initially divided into districts, each encompassing a geographically distinct area. These districts are denoted by Roman numerals, ranging from I to XII, with each representing a specific portion of Kauai.

- Section: Within each district, land is further subdivided into sections, identified by Arabic numerals. These sections are essentially subdivisions of the larger district, further delineating land areas.

- Subsection: Sections are further divided into subsections, denoted by letters of the alphabet. This level of division provides a more granular breakdown of land ownership within a section.

- Parcel: The final and most granular level of the system is the parcel, representing the smallest identifiable unit of land. Each parcel is assigned a unique number, typically a four-digit code, that serves as its definitive identifier.

Beyond the Numbers: Understanding the Significance of the Key

The Kauai Tax Map Key’s importance extends far beyond its simple numerical structure. It serves as a cornerstone for various critical functions, including:

- Property Identification and Ownership: The key provides a definitive system for identifying and tracking ownership of every parcel on the island. This information is crucial for legal and administrative purposes, ensuring clarity and accuracy in land transactions, property taxes, and other legal proceedings.

- Property Valuation and Assessment: The key facilitates the accurate valuation of properties, forming the basis for property tax assessments. This process ensures equitable distribution of tax burdens based on the value of individual properties.

- Land Use Planning and Development: The key is an essential tool for land use planning and development, providing a framework for understanding land ownership patterns and facilitating informed decisions regarding zoning, infrastructure development, and environmental protection.

- Emergency Response and Disaster Relief: In the event of emergencies or natural disasters, the key plays a crucial role in coordinating response efforts. It allows authorities to quickly identify affected areas, locate residents, and direct resources efficiently.

- Historical Research and Preservation: The key provides a historical record of land ownership, offering insights into the island’s development and the evolution of its landscape. This information is invaluable for historical research and preservation efforts.

Navigating the Key: Practical Applications

The Kauai Tax Map Key is a powerful tool that can be utilized by various individuals and entities:

- Property Owners: The key allows property owners to accurately identify their parcels, verify ownership information, and access relevant records.

- Real Estate Professionals: The key is indispensable for real estate agents and brokers, enabling them to conduct thorough property searches, identify potential clients, and facilitate transactions with accuracy.

- Government Agencies: The key is vital for government agencies, including the Department of Taxation, the Department of Planning, and the Department of Emergency Management. It provides essential information for managing property taxes, land use planning, and disaster response.

- Researchers and Historians: The key offers a valuable resource for researchers and historians seeking to understand the island’s land ownership patterns, development history, and cultural heritage.

FAQs Regarding the Kauai Tax Map Key

Q: Where can I access the Kauai Tax Map Key?

A: The Kauai Tax Map Key is available online through the Department of Taxation website, along with interactive maps and additional resources.

Q: How can I use the key to find a specific property?

A: The key can be used to locate a specific property by entering its unique parcel number or by searching by district, section, subsection, or address.

Q: What are the limitations of the Kauai Tax Map Key?

A: The key primarily focuses on land ownership and does not provide detailed information about property features, such as building size, construction type, or amenities.

Q: Can I use the key to determine the value of a property?

A: While the key can help identify a property’s location and size, it does not directly indicate its market value. Property valuation requires additional information and analysis.

Q: How often is the Kauai Tax Map Key updated?

A: The key is updated regularly to reflect changes in land ownership and property boundaries, ensuring accuracy and relevance.

Tips for Utilizing the Kauai Tax Map Key

- Familiarize yourself with the key’s structure and terminology. Understanding the hierarchical system of districts, sections, subsections, and parcels is crucial for effective navigation.

- Utilize the online resources provided by the Department of Taxation. These resources include interactive maps, search functions, and additional information about the key.

- Consult with a real estate professional or legal expert for specific questions or assistance. They can provide guidance on interpreting the key and its implications for property transactions.

Conclusion

The Kauai Tax Map Key is an indispensable tool for understanding the island’s intricate land ownership patterns and navigating its diverse landscape. Its comprehensive structure, detailed information, and accessibility make it a valuable resource for property owners, real estate professionals, government agencies, researchers, and anyone seeking to gain insights into the island’s land use and development history. By understanding the key’s structure and utilizing its resources, individuals can access valuable information and navigate the complexities of Kauai’s land ownership with greater clarity and efficiency.

Closure

Thus, we hope this article has provided valuable insights into Decoding the Landscape: A Comprehensive Guide to the Kauai Tax Map Key. We thank you for taking the time to read this article. See you in our next article!