Navigating Kauai’s Landscape: Understanding the County Tax Map Key

Related Articles: Navigating Kauai’s Landscape: Understanding the County Tax Map Key

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Kauai’s Landscape: Understanding the County Tax Map Key. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Kauai’s Landscape: Understanding the County Tax Map Key

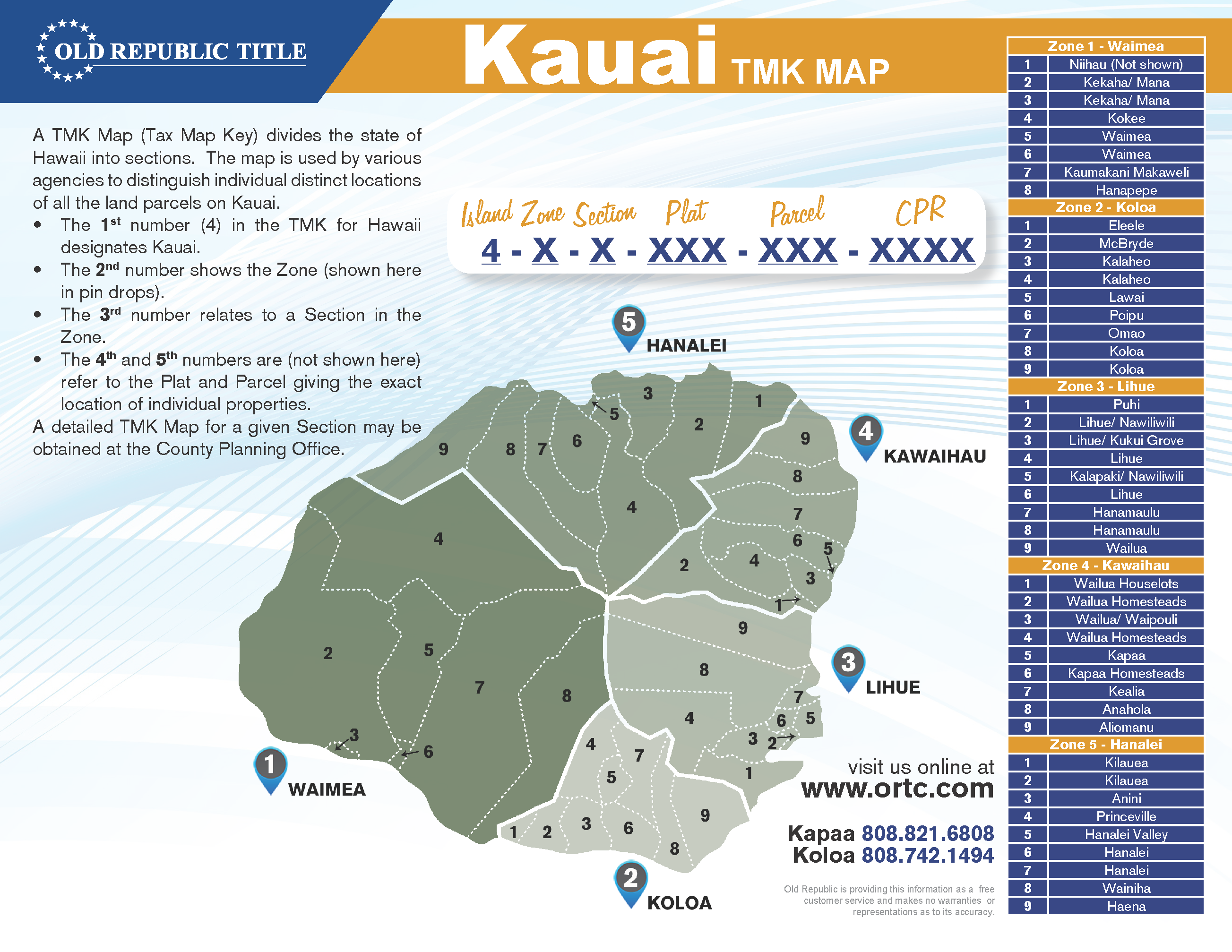

The County of Kauai Tax Map Key serves as a fundamental tool for understanding and navigating the island’s diverse geography and property ownership. This intricate system provides a comprehensive framework for identifying and locating properties, parcels, and land features, aiding in various aspects of land management, property transactions, and public access to information.

A Foundation for Land Management:

The Tax Map Key is an essential component of Kauai’s land management system. It allows the County to accurately track and assess property ownership, enabling efficient administration of property taxes, zoning regulations, and other land-related policies. By providing a standardized and consistent method for identifying properties, the Tax Map Key ensures clarity and transparency in land records, facilitating smooth and reliable transactions.

Understanding the Key’s Structure:

The County of Kauai Tax Map Key is structured as a hierarchical system, with each level representing a specific geographical or administrative subdivision. The primary level is the Tax District, encompassing a broad geographical area within the island. Each Tax District is further divided into Tax Areas, which represent smaller, more localized regions. Within each Tax Area, Tax Map Numbers are assigned to individual properties, parcels, or land features.

Decoding the Tax Map Number:

The Tax Map Number, a crucial element of the system, provides a unique identifier for each property. It typically consists of a series of digits separated by hyphens. The first set of digits represents the Tax Area, followed by a hyphen, and then the individual property or parcel number. This structure allows for easy identification and retrieval of property information within the Tax Map Key.

Accessing the Tax Map Key:

The County of Kauai provides access to the Tax Map Key through its official website. Users can navigate the interactive map, search for specific properties by address or Tax Map Number, and view detailed information about each property, including ownership details, property boundaries, and zoning classifications. This online platform serves as a valuable resource for residents, property owners, developers, and other stakeholders seeking information about land ownership and property characteristics.

Beyond Property Identification:

The Tax Map Key’s importance extends beyond property identification. It plays a crucial role in various aspects of island life:

- Emergency Response: First responders utilize the Tax Map Key to quickly locate properties during emergencies, ensuring timely and efficient response efforts.

- Infrastructure Planning: The Tax Map Key aids in planning and implementing infrastructure projects, such as road construction, utility networks, and public facilities.

- Environmental Management: The system assists in tracking land use changes, identifying environmentally sensitive areas, and implementing conservation efforts.

- Historical Research: The Tax Map Key can be a valuable resource for historians seeking to understand land ownership patterns and the evolution of the island’s landscape over time.

Frequently Asked Questions:

Q: How can I find the Tax Map Number for my property?

A: You can access the County of Kauai’s online Tax Map Key system and search by your property’s address. The system will display the corresponding Tax Map Number.

Q: What information is included in the Tax Map Key?

A: The Tax Map Key provides information about property ownership, boundaries, zoning classifications, and other relevant details.

Q: Can I use the Tax Map Key to identify specific land features, such as streams or roads?

A: While the primary focus of the Tax Map Key is property ownership, it may also include information about some land features, depending on the level of detail available.

Q: Is the Tax Map Key updated regularly?

A: The County of Kauai regularly updates the Tax Map Key to reflect changes in property ownership, zoning regulations, and other relevant information.

Tips for Utilizing the Tax Map Key:

- Familiarize yourself with the system’s structure and terminology.

- Utilize the online platform to search for specific properties or land features.

- Contact the County’s Department of Planning for assistance with interpreting the Tax Map Key.

- Keep in mind that the Tax Map Key is a dynamic system that undergoes regular updates.

Conclusion:

The County of Kauai Tax Map Key is a vital resource for understanding and navigating the island’s diverse landscape. It serves as a comprehensive framework for property identification, land management, and public access to information. By understanding the structure and functionality of this system, residents, property owners, and stakeholders can access valuable information about land ownership, property characteristics, and other relevant details, contributing to the efficient and informed management of Kauai’s unique and treasured environment.

Closure

Thus, we hope this article has provided valuable insights into Navigating Kauai’s Landscape: Understanding the County Tax Map Key. We thank you for taking the time to read this article. See you in our next article!