Navigating the Landscape of Kauai: Understanding the Tax Map Key

Related Articles: Navigating the Landscape of Kauai: Understanding the Tax Map Key

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Kauai: Understanding the Tax Map Key. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Kauai: Understanding the Tax Map Key

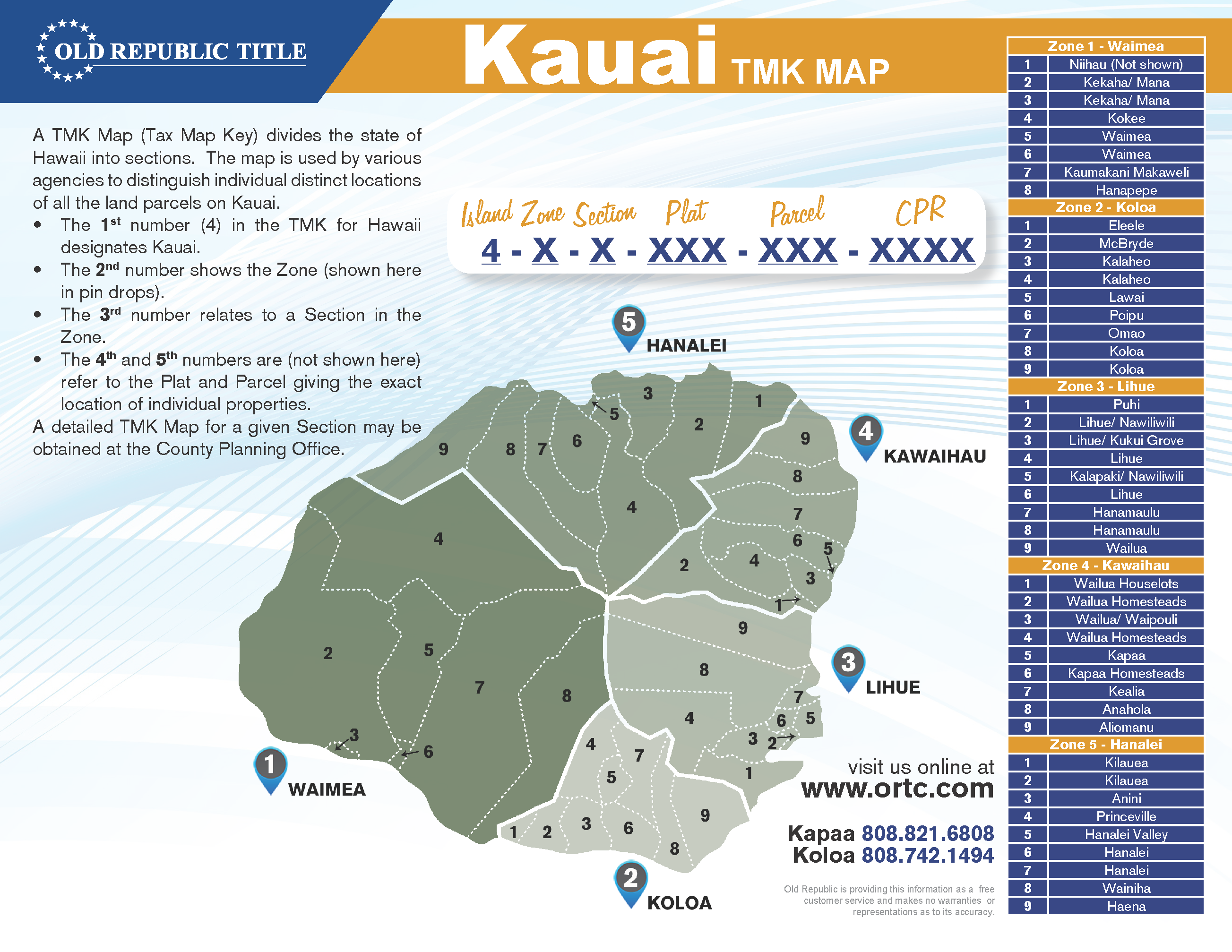

The Kauai Tax Map Key serves as an indispensable tool for navigating the island’s intricate land ownership and property information. This comprehensive system provides a detailed framework for identifying and locating parcels of land, facilitating essential tasks ranging from property transactions to environmental analysis. This article aims to provide a comprehensive understanding of the Kauai Tax Map Key, exploring its structure, applications, and significance in the context of the island’s unique geographical and administrative landscape.

The Foundation of Land Identification: A System of Grids and Numbers

The Kauai Tax Map Key utilizes a grid system overlaid on the island, dividing it into distinct areas identified by letters and numbers. These grid references are further subdivided into smaller units known as "tax map keys," each representing a specific parcel of land. The key itself comprises a series of numbers separated by hyphens, with each number signifying a particular aspect of the parcel’s location and characteristics.

Deciphering the Code: Unveiling the Parcel’s Identity

The first number in the tax map key represents the "Tax District," a broad geographical area encompassing multiple grid units. Subsequent numbers denote the specific grid unit and parcel number within that unit. This systematic approach ensures a unique identifier for every parcel on the island, facilitating precise location and identification.

Beyond Boundaries: Unveiling the Parcel’s Attributes

The Tax Map Key goes beyond mere location, providing insights into the parcel’s characteristics. Additional information, such as the parcel’s size, zoning designation, and ownership details, is often associated with the key. This comprehensive data allows for a deeper understanding of the parcel’s potential uses and restrictions, proving invaluable for various stakeholders.

Applications of the Tax Map Key: A Multifaceted Tool

The Kauai Tax Map Key finds diverse applications across various sectors, serving as a critical resource for:

- Real Estate Transactions: Real estate professionals rely on the Tax Map Key to identify and verify properties, ensuring accurate property descriptions and facilitating smooth transactions.

- Land Development and Planning: Developers and planners utilize the key to understand zoning regulations, property boundaries, and potential environmental constraints, informing their project planning and design.

- Environmental Management and Conservation: Environmental agencies leverage the Tax Map Key to track land ownership patterns, identify areas of ecological significance, and implement conservation strategies.

- Property Tax Assessment: The Tax Map Key serves as the foundation for property tax assessment, enabling accurate valuation and equitable distribution of tax burdens.

- Emergency Response and Disaster Relief: Emergency responders use the Tax Map Key to navigate the island efficiently, locate affected areas, and deploy resources effectively during natural disasters.

Navigating the System: Resources and Access

The Kauai Tax Map Key is readily accessible to the public through various channels:

- Kauai County Website: The official website of Kauai County provides a searchable database of tax map keys, allowing users to input key information and retrieve associated property details.

- Kauai County Planning Department: The Planning Department maintains comprehensive records and offers assistance in interpreting the Tax Map Key, guiding individuals through the system.

- GIS Mapping Tools: Geographic Information Systems (GIS) software and online mapping platforms often incorporate the Kauai Tax Map Key, enabling users to visualize parcel boundaries and associated attributes.

FAQs: Addressing Common Queries

1. How can I find the tax map key for a specific property?

The Kauai County website provides a search function where you can input the property address, owner name, or other relevant information to retrieve the corresponding tax map key.

2. What information is included in the tax map key?

The Tax Map Key typically includes the Tax District, grid unit, parcel number, size, zoning designation, and ownership details.

3. Can I access historical tax map data?

The Kauai County Planning Department may have access to historical tax map data, but availability and accessibility may vary.

4. What are the consequences of using an incorrect tax map key?

Using an incorrect tax map key can lead to errors in property identification, zoning compliance, and other critical aspects of land management.

5. Is the Tax Map Key updated regularly?

The Kauai Tax Map Key is regularly updated to reflect changes in land ownership, zoning regulations, and other relevant factors.

Tips: Maximizing the Use of the Tax Map Key

- Consult the Kauai County website and Planning Department: These resources provide comprehensive information and assistance in understanding and utilizing the Tax Map Key.

- Use GIS mapping tools: GIS platforms can visualize parcel boundaries and associated attributes, offering a powerful tool for analysis and planning.

- Verify information: Always double-check the accuracy of the retrieved information, as errors can occur.

- Seek professional guidance: For complex land-related matters, consult with real estate professionals or legal counsel to ensure accurate interpretation and application of the Tax Map Key.

Conclusion: A Vital Tool for Effective Land Management

The Kauai Tax Map Key stands as a vital tool for understanding and navigating the island’s complex land ownership and property information. Its comprehensive nature, accessibility, and diverse applications make it an indispensable resource for real estate professionals, developers, environmental agencies, and all individuals interested in the island’s unique landscape. By understanding and utilizing the Tax Map Key effectively, individuals and organizations can navigate the intricate world of land ownership, fostering responsible development, environmental stewardship, and a sustainable future for Kauai.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Kauai: Understanding the Tax Map Key. We appreciate your attention to our article. See you in our next article!