Navigating the Landscape of Maui: A Comprehensive Guide to the Tax Map Key

Related Articles: Navigating the Landscape of Maui: A Comprehensive Guide to the Tax Map Key

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Maui: A Comprehensive Guide to the Tax Map Key. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Maui: A Comprehensive Guide to the Tax Map Key

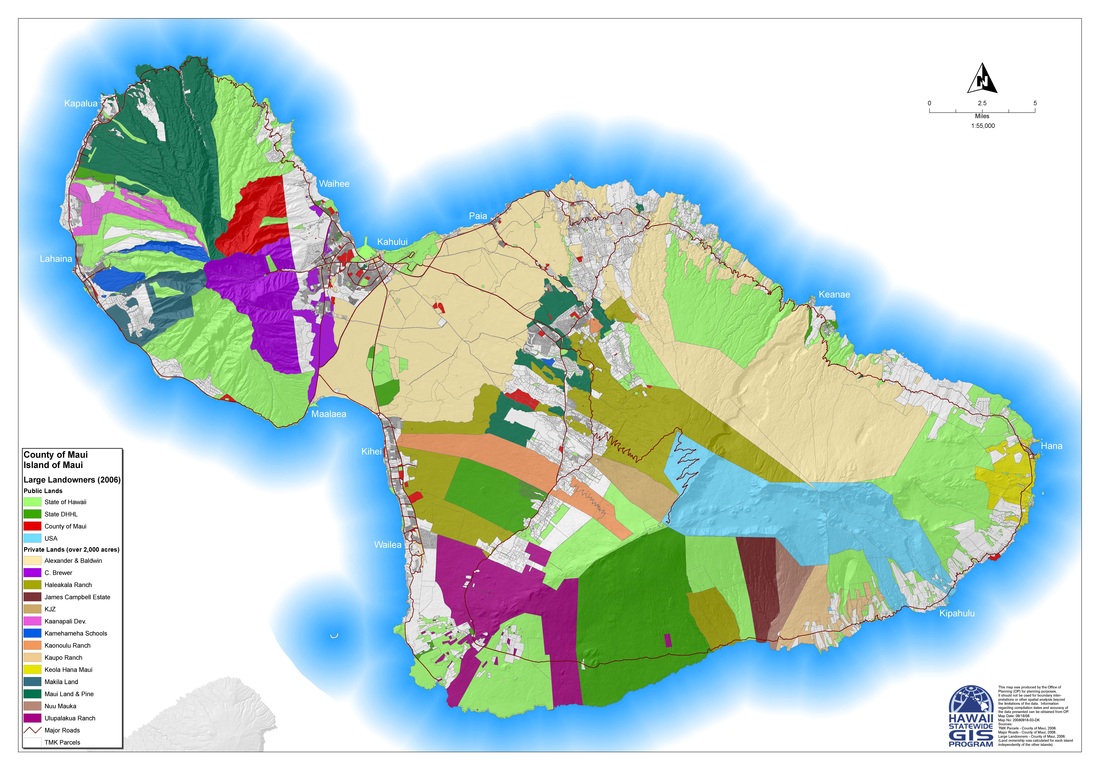

The Hawaiian islands, particularly Maui, are renowned for their breathtaking natural beauty. But beneath this picturesque exterior lies a complex system of land ownership and management. The Maui Tax Map Key, a vital tool for understanding this intricate landscape, serves as a roadmap for navigating property information and facilitating transactions. This article provides a comprehensive overview of the Maui Tax Map Key, exploring its structure, applications, and importance in various aspects of island life.

Understanding the Maui Tax Map Key

The Maui Tax Map Key is a comprehensive database that categorizes and identifies every parcel of land on the island. It serves as a unique identifier, akin to a street address, for each individual property. The key utilizes a hierarchical system, dividing the island into distinct geographical areas, further subdivided into smaller sections, ultimately reaching individual tax map keys for each property.

Components of the Tax Map Key

The Maui Tax Map Key consists of three primary components:

- District: This initial component broadly identifies the geographical region of the property. It reflects the island’s natural features, such as mountains, valleys, or coastal areas.

- Section: Within a district, the section further narrows down the property’s location, encompassing smaller geographical divisions.

- Parcel: The final and most specific component, the parcel number, uniquely identifies a single property within a specific section.

Applications of the Maui Tax Map Key

The Maui Tax Map Key plays a crucial role in various aspects of island life, serving as a vital tool for:

- Property Identification and Transactions: The key provides a standardized method for identifying and referencing specific properties, facilitating property transactions, including sales, rentals, and mortgages.

- Property Assessment and Taxation: Tax assessors utilize the key to determine the value of individual properties, enabling the accurate calculation of property taxes.

- Land Planning and Development: The key is instrumental in land planning and development initiatives, providing a clear understanding of property boundaries and land use regulations.

- Emergency Response and Disaster Relief: In emergency situations, the key enables first responders and relief organizations to quickly locate specific properties and facilitate aid distribution.

- Environmental Conservation and Management: The key aids in tracking land ownership and usage patterns, facilitating conservation efforts and environmental management initiatives.

Accessing the Maui Tax Map Key

The Maui Tax Map Key is publicly accessible through various resources:

- Maui County Real Property Tax Division: The primary source for accessing the key is the Maui County Real Property Tax Division website, where users can search for specific properties using the tax map key or other identifying information.

- Real Estate Agents and Brokers: Real estate professionals often have access to the key and can assist clients in locating and understanding property information.

- Online Mapping Services: Several online mapping services, such as Google Maps and Bing Maps, integrate the Maui Tax Map Key into their platforms, allowing users to visualize property boundaries and search for specific properties.

Importance of the Maui Tax Map Key

The Maui Tax Map Key plays a critical role in maintaining order and transparency within the island’s land ownership and management system. Its benefits extend beyond simple property identification, impacting various aspects of island life, including:

- Economic Development: The key facilitates land transactions, fostering economic growth and investment.

- Community Planning: By providing a clear understanding of property boundaries and land use, the key supports community planning initiatives and sustainable development.

- Public Safety: The key assists emergency responders in locating properties quickly and efficiently, improving public safety during emergencies.

- Environmental Protection: The key aids in monitoring land use patterns, enabling effective environmental protection and conservation efforts.

FAQs about the Maui Tax Map Key

Q: How do I find the tax map key for a specific property?

A: The most reliable method is to visit the Maui County Real Property Tax Division website and search using the property address or owner’s name. You can also consult with a real estate agent or utilize online mapping services that integrate the Maui Tax Map Key.

Q: Can I access the tax map key for free?

A: The Maui County Real Property Tax Division website provides free access to the tax map key database. However, certain online mapping services may charge fees for accessing specific features or data.

Q: Is the Maui Tax Map Key constantly updated?

A: The Maui County Real Property Tax Division regularly updates the tax map key to reflect changes in property ownership, boundaries, and land use.

Q: What if I cannot find the tax map key for a property?

A: If you are unable to locate the tax map key for a specific property, contact the Maui County Real Property Tax Division for assistance. They can provide guidance and access to the necessary information.

Tips for Using the Maui Tax Map Key

- Familiarize yourself with the key’s structure: Understanding the three components (district, section, and parcel) will help you navigate the database effectively.

- Use reliable sources: Consult the official Maui County Real Property Tax Division website or reputable real estate professionals for accurate information.

- Verify information: Always confirm the accuracy of the tax map key data before making any decisions or transactions based on it.

- Stay informed about updates: The tax map key is subject to changes, so it’s essential to stay informed about the latest updates and revisions.

Conclusion

The Maui Tax Map Key serves as a fundamental tool for navigating the complex landscape of land ownership and management on the island. Its comprehensive nature and accessibility make it a valuable resource for various stakeholders, including property owners, real estate professionals, government agencies, and the public. By understanding the structure and applications of the Maui Tax Map Key, individuals can gain a deeper insight into the island’s land ownership patterns and participate effectively in various aspects of island life, from property transactions to community planning and environmental conservation.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Maui: A Comprehensive Guide to the Tax Map Key. We hope you find this article informative and beneficial. See you in our next article!